The 2023 South Florida real estate market, like national trends, saw a decrease in sales, an increase in prices, and a decrease in the number of homes listed and placed under contract. Unlike what the Northeast experienced, South Florida inventory is up over 2022 and the second half of 2021. That said, the number of homes sold is down year-over-year, so it’s a true sign that the voracious buyer activity has slowed and that this region is slightly ahead of the North in the market adjustment cycle.

The 2023 South Florida real estate market, like national trends, saw a decrease in sales, an increase in prices, and a decrease in the number of homes listed and placed under contract. Unlike what the Northeast experienced, South Florida inventory is up over 2022 and the second half of 2021. That said, the number of homes sold is down year-over-year, so it’s a true sign that the voracious buyer activity has slowed and that this region is slightly ahead of the North in the market adjustment cycle.

2022 also experienced a decline in sales compared to 2021, accompanied by attention-grabbing headlines and fueling concerns about an impending market crash. However, Anthony clarified at that time that such an outcome was unlikely. Fast forward to the present, and no crash has occurred. 2023’s slower market activity reflects a shift towards equilibrium. Despite the necessity of this market adjustment, the process can be painful, and 2023 was undoubtedly a challenging year for all involved.

Florida made the headlines in 2023 as the state with the highest in-migration, so the state as a whole is popular among transplants for reasons such as lower taxes and warm weather. This report, however, analyzes South Florida which includes: Palm Beach, Broward, and Miami-Dade counties, and the sales, average prices, number of active listings, and listings under contract for 2023 compared to 2022. Additionally, it offers predictions for what is expected to unfold in real estate in 2024.

2024 Real Estate Performance Highlights

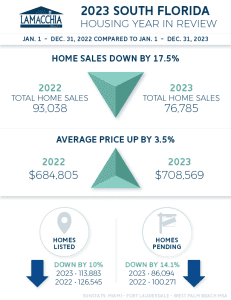

- The number of homes sold decreased by 17.5%

- Average prices for closed sales increased by 3.5%

- The number of homes listed decreased by 10%

- The number of homes placed under contract decreased by 14.1%

- Inventory has risen year over year, contrary to the lows that the Northeast has seen.

- In conclusion… 2024 is predicted to be more of the same, with rising inventory, stabilization of prices, and, if rates stay level, slightly higher sales.

South Florida Sales Decline by 17.5%

South Florida witnessed a 17.5% drop in sales, decreasing from 93,038 in 2022 to 76,785 by the end of 2023. This translates to a year-over-year decline of 16,253 sales. The decrease can be attributed to buyers grappling with affordability challenges arising from increased interest rates and continuously rising prices.

Condos have been experiencing greater decreases than single families with their overall sales decline at 21.8% and single families down 12.1%. Condos have been under scrutiny since the Champlain Tower collapse in Surfside and the subsequent tightening up of condo regulations. These regulations have made it more complex to purchase a unit in an older building, and therefore have substantially increased HOA fees to cover the costs of the newly required special assessments. The more difficult it is to sell a condo, the longer the property will sit on the market, and eventually sellers will have to lower the list price to appeal to more buyers.

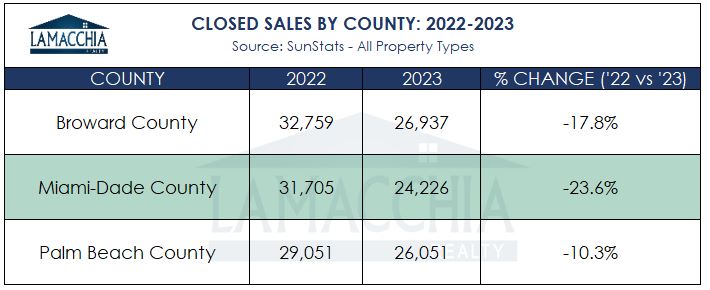

Sales were down in all three counties as depicted in the chart below. Miami-Dade County took the largest hit, down by nearly 24%.

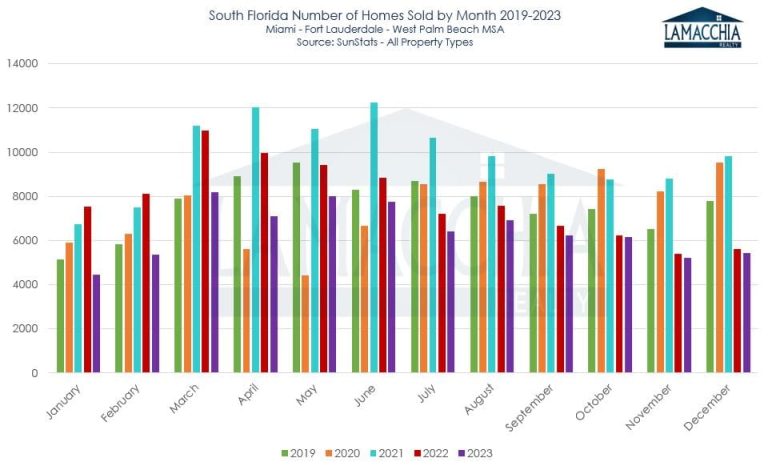

In the chart below you’ll see that the number of single-family homes sold is the lowest it has been in South Florida since 2011. This can be attributed to the market recovery that is unfolding nationally as the historic frenzy of 2021 calms down. Condo sales are at the lowest point since 2010. In 2021 and 2022 condo sales were substantially higher than single families, but in 2023 the gap began to close.

Monthly, the story is essentially the same, and it’s clear that monthly sales in all three counties combined have been down year over year for the entirety of 2023.

South Florida Average Prices Increase by 3.5%

Despite the affordability challenges exerting pressure on buyers, prices still increased year over year albeit at a lower rate than last year. Miami-Dade prices increased by the smallest amount this year, but it is the most expensive of the three counties, so this is a welcome change for buyers. Prices increased the most in Palm Beach County, showing that demand is still very strong in that area.

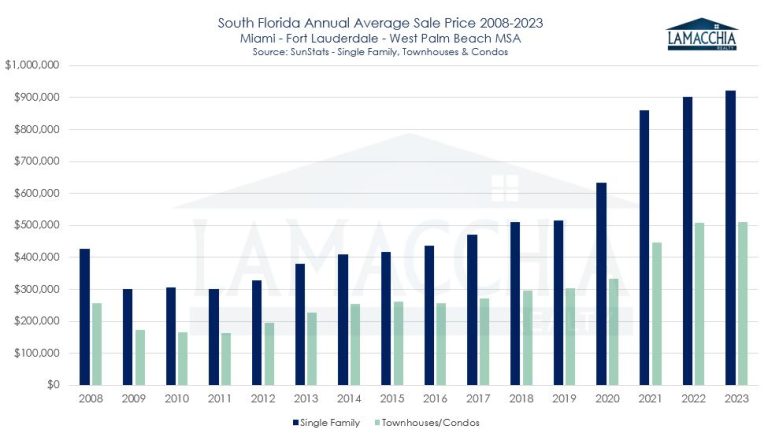

Singles family prices increased by 2.4%; now at $923,060 from $901,473 in 2022, and condos stayed relatively flat at a 0.7% increase; now at $511,718 from $508,001. The leveling off in prices suggests that buyers aren’t competing as they were over the past few years as those bidding wars were what caused prices to spike as they did in 2021.

Again, condos have had a rougher go of it. The more difficult it is to sell a condo, the longer the property will sit on the market, and eventually sellers will have to lower the list price to appeal to more buyers. This is potentially something we will see more of in 2024. Those who made condo purchases during COVID may be coming to the realization it may not be worthwhile to own now that working from anywhere is less of an option. And some are not able to sustain the rising HOA fees and insurance rates.

It’s clear in the chart below that prices for both single families and condos are leveling off from the prior year, and that condo prices barely budged year over year.

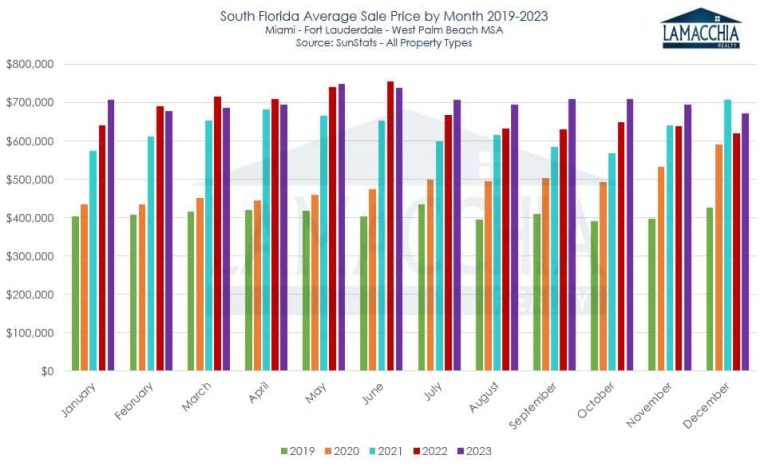

Another view of price performance is in the bar chart below where you can see how monthly prices have performed year over year since 2019. Though prices are still higher than they were even after the 2021 spike, the rate at which they’ve climbed is less significant and was even down in some months in 2023.

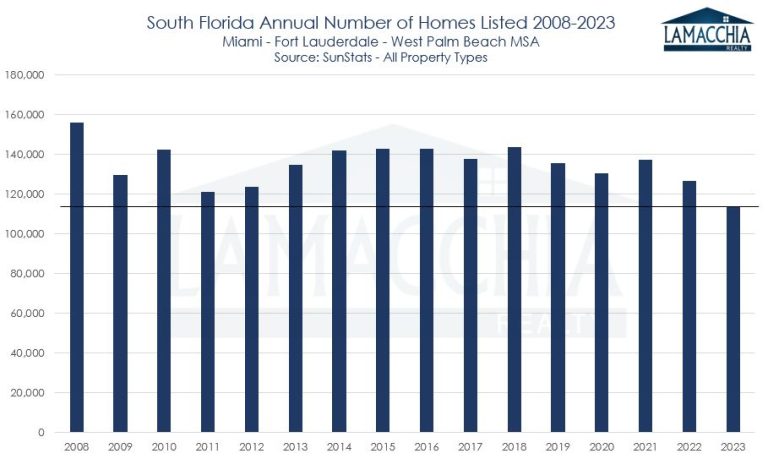

2023 Sees the Lowest Number of Homes Listed in Fifteen Years

There was a 10% decrease in the number of new listings compared to 2022, with 113,883 homes listed in South Florida, down from 126,545. Sellers are exercising caution in listing their homes, not only to preserve pandemic-era rates but also due to concerns about higher monthly payments when making a new purchase. This hesitancy, spanning two years, has resulted in the lowest number of new listings since 2008.

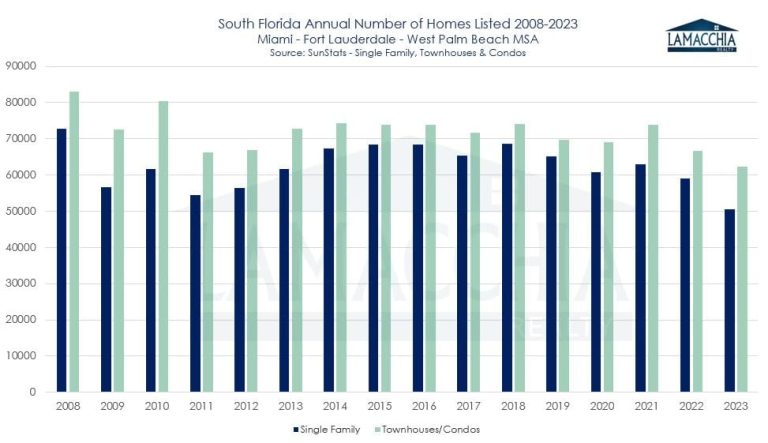

Contrary to the notion that interest rates only impact buyers, 2023 demonstrates the impact on sellers. Their reluctance, among other factors such as affordability challenges due to rates, insurance prices and HOA fees, contributes to lower closed sales and lower pending sales. You can see in the chart below that it’s standard for there to be more condos listed than single families, however the gap has been rising over the past few years. Condos are flooding the market, and with all that selection buyers will not have to compete financially allowing prices to continue to flatline or descend if there is more supply than demand.

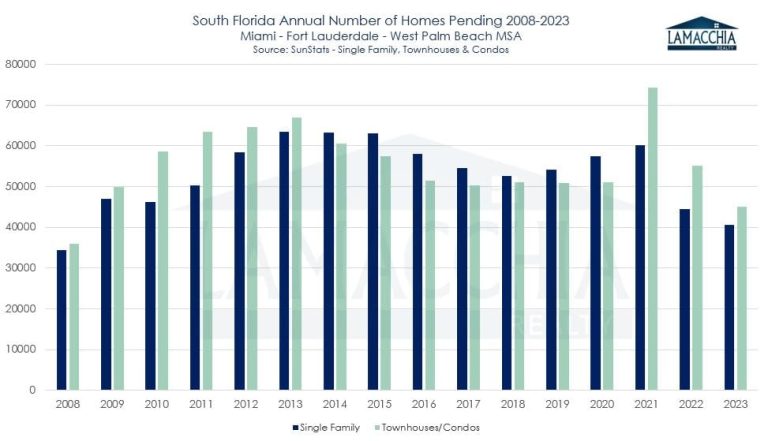

Pending Sales Decreased by 14.1%

Similar to national trends, the number of pending sales is down and in South Florida they’re down to the lowest point since 2008. The culprit isn’t inventory like it is in the northern states, but more affordability due to the rising costs of homeownership after the sale, although prices have relatively flat-lined, they are still exorbitantly high compared to 2019 and prior. Fewer pending sales have contributed to the rising inventory in South Florida.

Similar to other metrics, the gap is closing between single families and condos for the number of pending sales as condo number continue to decline.

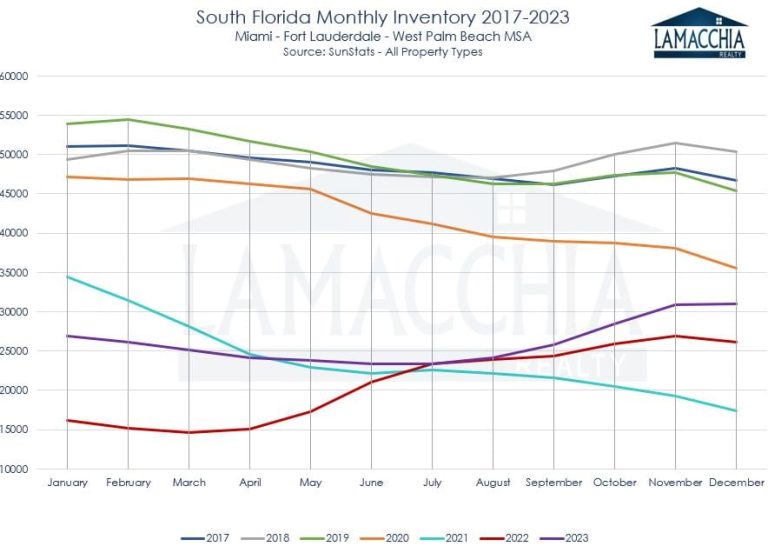

South Florida Inventory Has Risen

Rising inventory in South Florida has allowed prices to soften as buyers aren’t competing as they were during 2021. Mid-2022 was when inventory began to rise year-over-year and the climb lasted until the present day. 2023 ended with inventory levels close to the end of 2020 before the frenzy of 2021.

Will the 2024 Real Estate Market Improve?

As Anthony stated in his predictions, prices could see a decrease ranging from 3% to 5% for single-family homes and a slightly more significant decrease for condos, falling within the range of 5% to 8%. The observable increase in rental inventory and the downward trend in rents support this projection. Historical patterns indicate that when rents reach a point where they no longer cover mortgage and other expenses, property owners tend to list their properties for sale. Condo expenses are on the rise due to increasing condo fees and the implementation of special assessments.

It’s worth noting that Miami could serve as a wildcard in this scenario. The county may play a pivotal role in stabilizing the market as it continues to attract a large number of individuals and businesses, particularly those in the higher-end buyer segment. This market deceleration is positive news for potential buyers, and they should consider taking advantage of the current conditions. However, it’s essential to act promptly, as this slowdown is expected to be temporary, given the substantial demand for properties in Florida.