2023 was a notable year in real estate history, but if we had to put our finger on what stood out, it was how the number of homes listed was the lowest in over two decades. It kept inventory down, which propped up prices, but sales are down nearly 22%, and buyers are hungry. With rates trying to reach equilibrium after their nosedive in 2020, everyone has had to accept that pandemic-era rates are a thing of the past and therefore higher monthly mortgage payments are here to stay.

2023 was a notable year in real estate history, but if we had to put our finger on what stood out, it was how the number of homes listed was the lowest in over two decades. It kept inventory down, which propped up prices, but sales are down nearly 22%, and buyers are hungry. With rates trying to reach equilibrium after their nosedive in 2020, everyone has had to accept that pandemic-era rates are a thing of the past and therefore higher monthly mortgage payments are here to stay.

2022 was down in sales from 2021 just like this past year, and at that time, many were concerned that it was a sign the market was about to crash, something Anthony has repeatedly disproved. A year later, still no crash, which had more to do with the decrease in inventory than the decrease in sales. Sales being down in 2022 wasn’t much of a surprise, more of a relief, because the frenzied 2021 market was unsustainable and real estate was begging for a sense of normalcy. Slower market activity this year, however, is representative of the journey back to equilibrium. Regardless of how necessary a market adjustment is, it can be painful and 2023 didn’t disappoint.

This report breaks down sales, average prices, the number of active listings, and how many listings went under contract for 2023 compared to 2022 and discusses what is predicted to unfold in 2024.

2023 Real Estate Performance Highlights

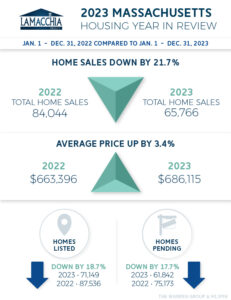

- The number of homes sold decreased by 21.7%

- Average prices for closed sales increased by 3.4%

- Lowest number of homes listed in recorded history, decreased by 18.7%

- The number of homes placed under contract (pending), decreased by 17.7%

- Low inventory has essentially propped up prices due to demand still outpacing such low supply

- In conclusion… 2024 is predicted to be slightly better.

Sales Decline by 21.7% Massachusetts

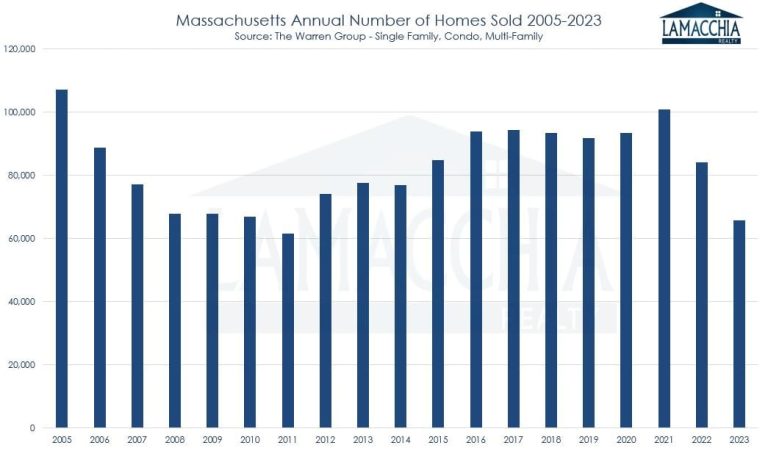

Sales in Massachusetts declined from 84,044 in 2022 and came in at 65,766 at the end of 2023– 18,278 fewer sales year over year. Some of that had to do with buyers feeling the affordability crunch of higher interest rates and still-rising prices. A lot of it had to do with anemic inventory.

Sales were down in all three categories:

- Single family sales down by 22.1%: 40,828 in 2023 from 52,397 in 2022

- Condo sales down by 18.7%: 19,199 in 2023 from 23,616 in 2022

- Multi-family sales down by 28.5%: 5,739 in 2023 from 8,031 in 2022

Below is a graph that illustrates home sales per year since 2005. 2023 produced the lowest number of home sales since 2005 with the exception of 2011.

Monthly sales were down every month this past year over the previous four years, with the exception of May and June 2022 when COVID hit (due to the closing lag, it was late spring that appeared down, but those contracts were accepted in late winter when the stay-at-home mandate was in place).

Average Prices Increase by 3.4%

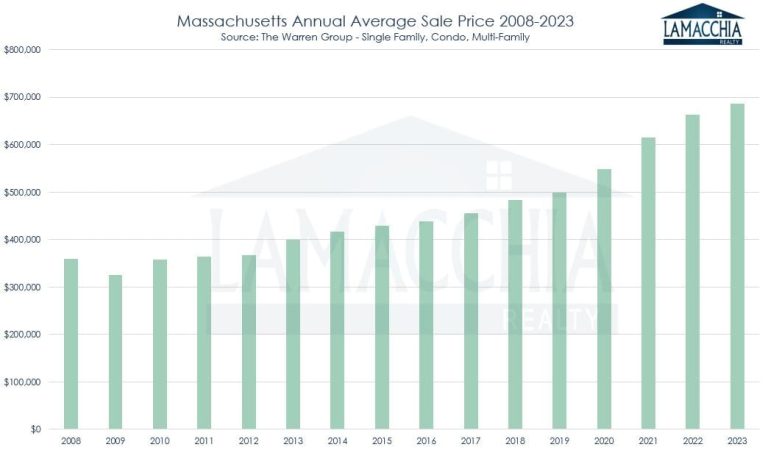

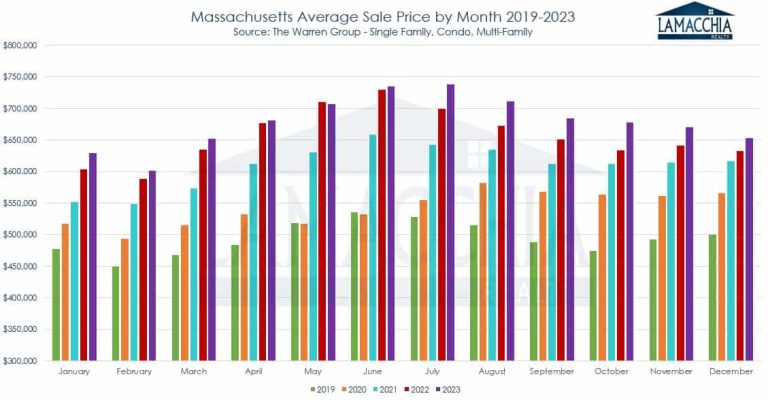

Prices in 2023 increased over 2022 by $22,720 with 2023 at $686,115 compared to $663,396 in 2022. Despite the affordability pressure, prices are still rising because inventory is still low enough that motivated buyers are competing with multiple offers thereby driving sales prices up.

Prices increased in all three categories:

- Single family prices increased by 2.7%: $709,119 in 2023 from $690,589 in 2022

- Condo prices increased by 5.1%: $646,669 in 2023 from $615,118 in 2022

- Multi-family prices increased by 4.2%: $654,426 in 2023 from $627,941 in 2022

In the bar chart below, you’ll see that 2023 had the highest average prices since 2008, and the highest ever. The increase year-over-year wasn’t as significant as the increase from 2020 to 2021, which is a sign that things are calming down, but an increase is still an increase and confirmation that a price crash still isn’t on the horizon.

With the exception of last May, monthly prices were up over 2022. Similar to the annual rise, the year-over-year increases were slight compared to the previous year’s increases.

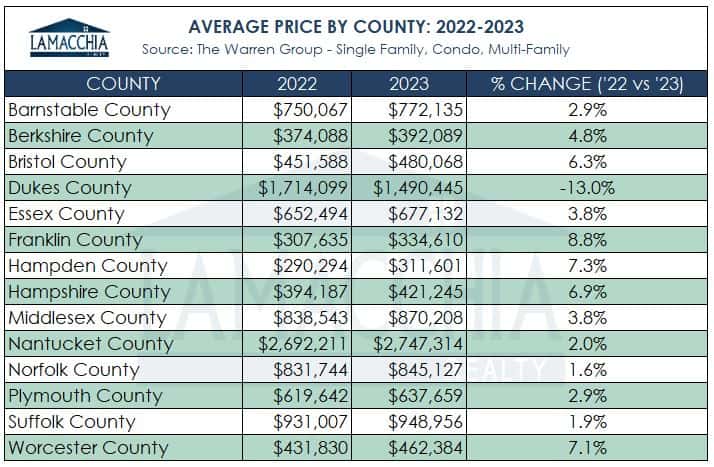

Average price changes by county ranged from a decrease of 13% to an increase of 8.8%. Generally speaking, the higher priced counties showed lower gains, and the more moderately priced counties exhibited larger increases. People are moving away from those higher priced areas as demand for affordability is forced to spread out geographically.

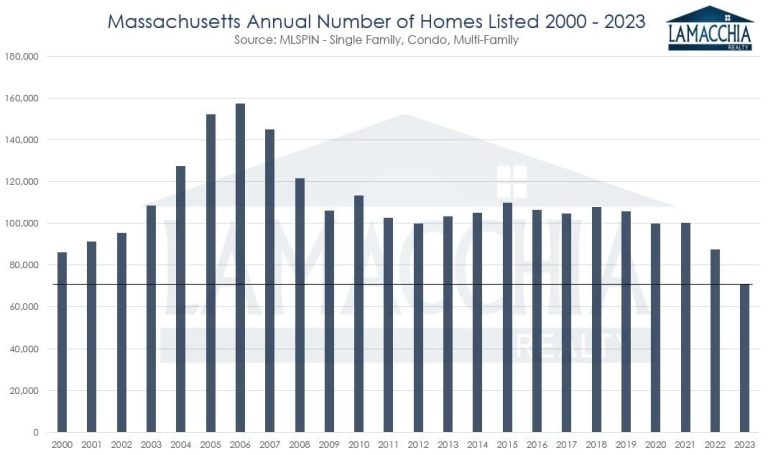

2023 Sees the Lowest Number of Homes Listed in Twenty-Three Years

Listings are down 18.7% in 2023 compared to 2022. There were 71,149 homes listed on the market compared to 2022, which had 87,536. Sellers are sitting on their hands because although they may want to move, they’re hesitating to do so because they don’t want to trade in their pandemic-era rates. Therefore, we are in a market with the lowest amount of new listings since 1994.

It’s a misconception that rates only impact buyers and 2023 is a perfect example of that. Sellers are stuck not just because they don’t want to lose their rate; those who need to buy again are concerned about the possibility of much higher monthly payments. The lack of listings is a major factor in how low inventory is, so buyers are still competing, and this is why prices haven’t fallen. If we ever see inventory rise significantly then we can be concerned about prices falling. However, in the chart below you’ll see how 2004 – 2006 exhibited giant leaps in the number of homes listed, which drove up supply at a time when demand was very low, eventually resulting in the housing crisis. The opposite is happening now.

Pending Sales Decreased by 17.7%

With the exception of 2011, 2023 ended with the lowest number of pending sales since 2000. This time, it’s not for lack of demand, but lack of supply. There were 61,842 homes that were placed under contract in 2023, down 17.7% from 2022 when there were 75,173. You can’t buy what isn’t available.

Massachusetts Housing Inventory is Still Quite Low

Listings are down, but so are pending and closed sales. If sellers start to list in a more rapid fashion, and the pending and closed sales continue to decrease, inventory will increase, thus putting downward pressure on prices. Unless that happens, prices are going to remain consistent, and demand will still outweigh supply.

In the line graph below, 2023 is represented by the purple line which has trended similarly but generally lower than both 2022 and 2021. The end of 2021 into the beginning of 2022, was the lowest inventory in at least the past eight years, and it’s likely that we wouldn’t have seen the subsequent increase after that had it not been for the rise in mortgage rates. The rise in rates combined with inflation, pinched buyer spending and caused inventory to start ticking back up, but we are still nowhere near the levels we were at before the pandemic and that’s because many sellers are hesitant to list their homes for sale.

Will the 2024 Real Estate Market Improve?

Adding to the frustration of the 2023 market, is the paradox of how mortgage rates were able to produce positive and negative effects simultaneously. Rates stalled both buyers and sellers (negative), and slowed down the frenzied buyer activity, which allowed the inventory to rise (positive); yet sellers are listing less now than ever (negative) because they are unwilling to trade in a 3% rate for a 6% rate.

2021’s theme was buyer demand; 2022’s theme was rapid increases in mortgage rates; and 2023’s theme was all about a lack of inventory and decreased affordability. It was only the highly motivated buyers and sellers – those with life changes, like divorce or relocations, that transacted in the 2023 market.

We expect the theme for 2024 to be an ease in pressure. In Anthony’s 2024 Predictions, he says “the worst is behind us, but we are not out of the woods.” It appears that the market will still be slow for sure, but sales should increase slightly if rates trend downward and stay there. Hopefully, that will make would-be sellers more motivated to list, which should cause inventory to rise and in turn prices can slow their rise, level off, or even fall just a bit.

Buyers will be able to take advantage of rates likely lower than in 2023 and mortgage programs such as buydowns and mortgage assumptions also help with getting lower rates. Sellers will and should take advantage of the lower inventory when demand is still high to make the most out of the sale. Rates are going to reach a new normal, which if they rest in the 5%’s or 6%’s is historically very moderate.