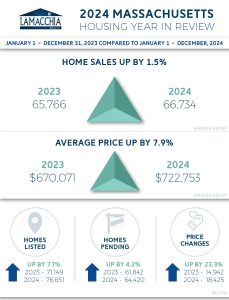

As stated last month in Anthony’s Predictions for 2025, “2024 will go down in history as the bottom of this down cycle.” Though we did see year over year increases in all categories, they were nominal where we prefer to see stronger gains.

In 2024, the Massachusetts real estate market saw slightly more sales and higher prices than 2023, reflecting national trends driven by strong demand and limited inventory. Many sellers were reluctant to list due to low pre-pandemic mortgage rates, but increased activity emerged from necessity and life changes, with competitive pricing becoming essential. Buyers remained determined despite affordability challenges from rising rates and home prices. The market began as a seller’s market but shifted toward buyers with a burst of activity later in the year, and a rebound is expected in 2025. Despite rising costs, homeownership remained appealing due to fixed payments, equity growth, and potential tax benefits, reinforcing its long-term value over renting.

This report breaks down sales, average prices, the number of active listings, and how many listings went under contract for 2024 compared to 2023 and discusses what is predicted to unfold in 2024.

Sales Rise by 1.5 Massachusetts

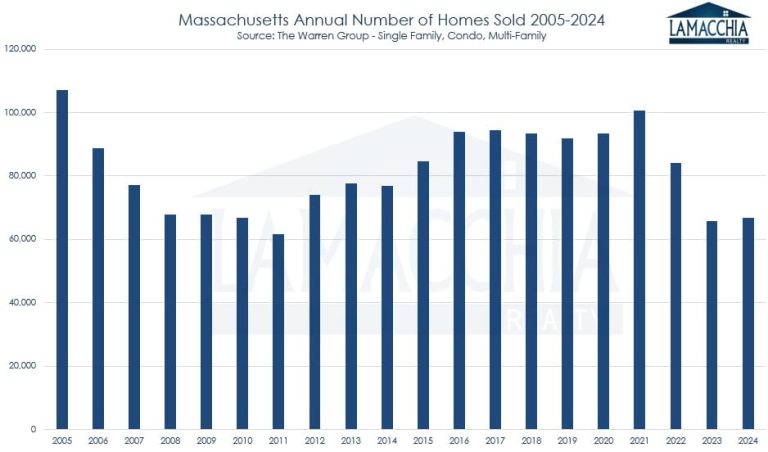

Sales in Massachusetts increased from 65,766 in 2023 and came in at 66,734 at the end of 2024– just a little under a thousand more sales year over year. Buyers are growing more accustomed to the rates. This level of affordability isn’t likely to change drastically in 2025, so those with life changes made the move or are gearing up to do so, and as well, many of those would-be sellers who were holding out got sick of waiting for the market to shift.

Sales were up in two out of three categories:

- Single family sales up by 2.9%: 42,023 in 2024 from 40,828 in 2023

- Condo sales down by 2.3%: 18,767 in 2024 from 19,199 in 2023

- Multi-family sales up by 3.6%: 5,944 in 2024 from 5,739 in 2023

Below is a graph that illustrates home sales per year since 2005. 2024 was the third lowest number of homes sales since 2005, only slightly higher than 2023.

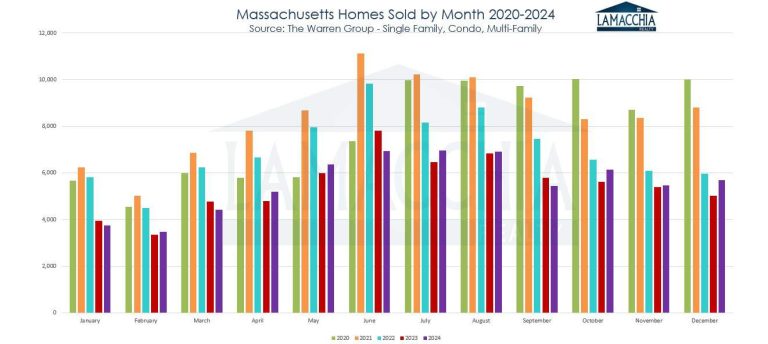

Monthly sales were down only four times this past year over the previous year. Sales failed to beat the same month the previous year in January, March, June and September. Though there were more increases than not, we aren’t even close to the frenzy we saw in the post-Covid market.

Average Prices Increase by 7.4%

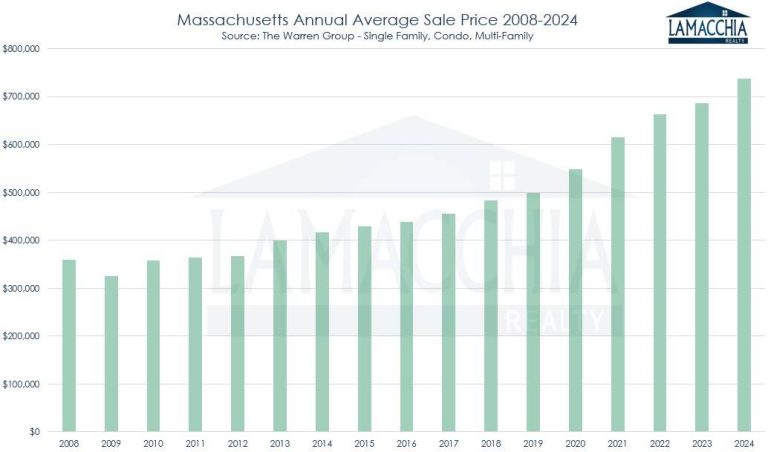

Prices in 2024 increased over 2023 by $50,632 with 2024 at $736,787 compared to $686.115 in 2023. Despite affordability challenges, prices continue to rise as limited inventory drives competition among motivated buyers, often leading to multiple offers and higher sales prices.

Prices increased in all three categories:

- Single family prices increased by 8%: $766,085 in 2024 from $709,119 in 2023

- Condo prices increased by 4.2%: $673,873 in 2024 from $646,669 in 2023

- Multi-family prices increased by 11.3%: $728,301 in 2024 from $654,426 in 2023

In the bar chart below, you’ll see that 2024 had the highest average prices since 2008, and quite frankly, the highest ever. As long as inventory is tight and buyers are competing for homes, prices will continue to hold firm.

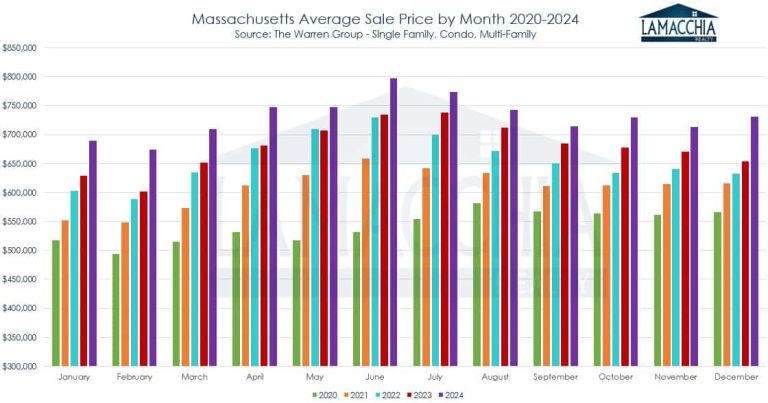

Monthly prices were up over 2023 every month in 2024. It’s incredible to get a sense of the increase since Covid when you compare the green line for 2020 and compare it to the purple one for 2024.

Average prices rose in every Massachusetts county, with increases ranging from 2.2% to 11.7%. This shows that demand is everywhere, not just on the coast or near cities. Furthermore, it shows that people are moving further away from the city as all Massachusetts counties are showing significant increases.

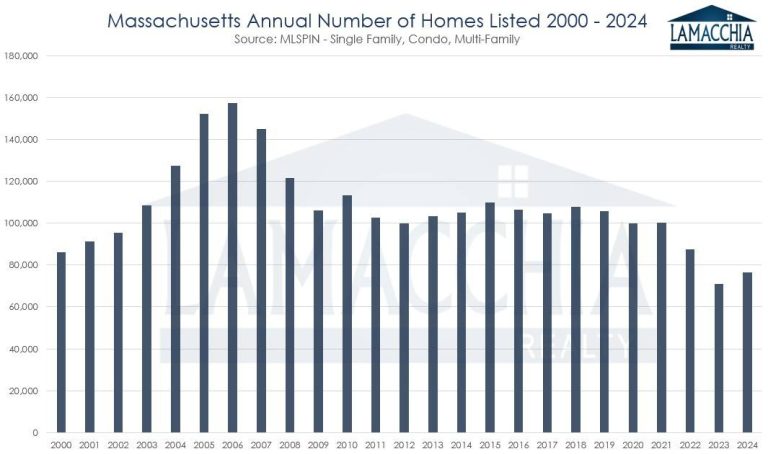

2024 Listings Rise for the First Time in Two Years

After two years of significant decreases in the number of homes listed, with last year being lowest amount of new listings since 1994, 2024 exhibited a 7.7% rise in the number of listings. Sellers had been hesitating to list because they wanted to hold onto their pandemic era rates. At a certain point, many of those sellers decided the wait had to be over. It was time to move on, and so this jump in listings likely represents the pent-up sellers deciding to move on. We aren’t back to the level that had been considered the norm for years with roughly 100,000 homes listed in Massachusetts annually, we are still only around 76,000 but inching up is a good sign that 2025 will have more inventory and buyers will see more selection.

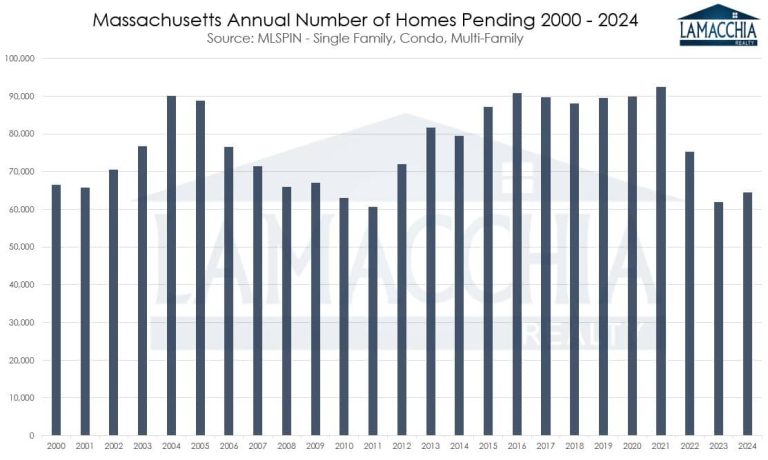

Pending Sales Increased by 4.2%

2023 ended with the lowest number of pending sales since 2011 due to lack of supply, not demand. Fortunately, 2024 saw an increase in pending sales which contributed to the rise in closed sales. The 4.2% rise ended 2024 with 64,420 pending sales compared to 61,842 the previous year.

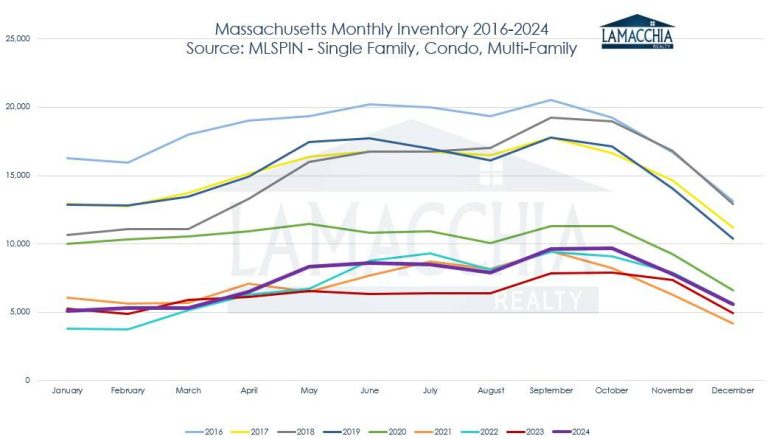

Massachusetts Housing Inventory is Still Quite Low

We can see 2024, with the purple line, landing steadily higher than 2023’s monthly inventory levels in the graph below. Again, it’s really telling to see where current inventory is falling when you compare it to the years prior to 2020. Those years hovered around 13,000-17,000 range where the past few years we have seen levels as low as 5,000 and at most around 9,000 in October of 2024, which happened to be one of the strongest months for real estate we’d seen in years.

Will the 2025 Real Estate Market Improve?

In 2025, the Massachusetts housing market is expected to see moderate growth, with home prices rising at a slower pace compared to recent years. The National Association of REALTORS® projects a nationwide increase of 2% in home prices, with Boston highlighted as one of the top housing market hot spots. Stabilizing mortgage rates, likely hovering around 6%, and an increase in housing inventory are expected to create better opportunities for buyers, particularly those who have struggled with fierce competition in previous years. Active buyers must stay proactive and well-prepared to act quickly when they find a property that meets their needs. However, affordability challenges will likely persist, driven by the state’s historically high property values and elevated cost of living.

The rental market is also expected to remain expensive, as rising demand for rental properties outpaces supply, leaving little relief for renters. For sellers, the market is anticipated to remain strong but more balanced, requiring realistic pricing to attract buyers in a slightly less heated environment. Overall, the Massachusetts housing market is expected to stabilize, creating a healthier dynamic between supply and demand, and setting the stage for a more sustainable pace of growth. As Anthony stated in his 2025 Predictions, “I believe 2025 will mark the beginning of this recovery, with 2026 poised to be a historic year for the industry as sales normalize.”